what is the property tax rate in ventura county

Customarily whole-year real estate taxes are paid upfront at the beginning of the tax year. Ventura Property Taxes Range.

Property Tax By County Property Tax Calculator Rethority

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

. Ad Find Information On Any Ventura County Property. Secured Tax bills for the new fiscal year 2022-2023 will be available in October 2022. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700.

At the same time tax liability switches with the ownership transfer. By Mail - Mailing address is - Homeowners Exemption Section The Ventura County Assessors Office 800 South Victoria Avenue Ventura CA 93009-1270. Specify Homeowners Exemption Section on your fax.

Tax Rates and Info - Ventura County. The 2018 United States Supreme Court decision in South Dakota v. The property tax rate is 1 of the assessed value plus any voter approved bonds fees or special assessments.

Need Property Records For Properties In Ventura County. The California state sales tax rate is currently. County of Ventura - WebTax - Search for Property.

The Ventura County sales tax rate is. 4 rows The median property tax in Ventura County California is 3372 per year for a home worth. The median property tax on a 56870000 house is 420838 in California.

In Person - Visit the Assessors Office at the County Government Center. In addition the property tax rates for particular portions of a city may differ from what is above due to specific Tax Rate Area. What is the sales tax rate in Ventura County.

This is the total of state and county sales tax rates. They range from the county to Ventura school district and many other special purpose entities such as sewage treatment plants amusement parks and property maintenance facilities. Ventura County collects on average 059 of a propertys assessed fair market value as property tax.

Based on latest data from the US Census Bureau. Tax Rate Database - Ventura County. Please note that the above Property and Sales tax rates are subject to change and may have changed since publication.

Ventura Property Taxes Range. The minimum combined 2022 sales tax rate for Ventura County California is. Thousand Oaks Newbury Park and Westlake.

The median property tax on a 56870000 house is 335533 in Ventura County. Average Property Tax Rate in Ventura. When buying a house ownership is transferred from the former owner to the buyer.

In Person - Visit the Assessors Office at the County Government Center - Hall of Administration 800 South. With that who pays property taxes at closing while buying a house in Ventura County. By Mail - Mailing address is - Homeowners Exemption Section The Ventura County Assessors Office 800 South Victoria Avenue Ventura CA 93009-1270.

As of July 1 2022 any unpaid Secured Tax Bills from 2021-2022 fiscal year are now defaulted and CANNOT BE PAID ONLINE. Please do not enter dashes when searching by APN number. Thousand Oaks includes Newbury Park and Ventura area of Westlake Village.

7 rows Property Tax Rate. By Fax - Fax 805 645-1305. The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of 059 of property value.

The median property tax on a 56870000 house is 597135 in the United States.

California Sales Tax Guide For Businesses

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Ventura County Ca Property Tax Search And Records Propertyshark

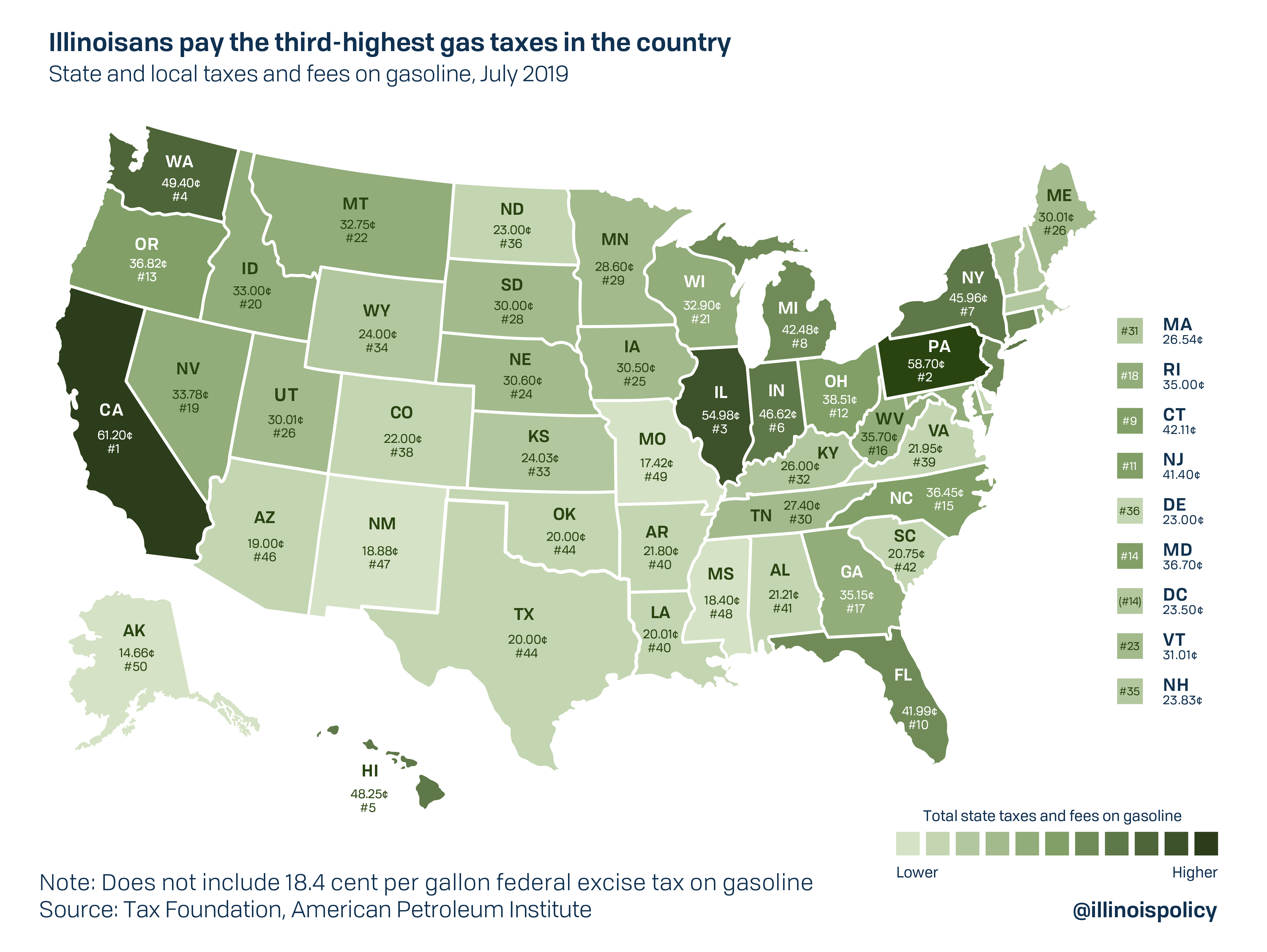

Will County Board Approves New 12m Gas Tax Atop Doubled State Tax

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Illinois Tax

Ventura And Los Angeles County Property And Sales Tax Rates

Property Tax California H R Block

Property Tax By County Property Tax Calculator Rethority

Property Tax By County Property Tax Calculator Rethority

Ventura And Los Angeles County Property And Sales Tax Rates

The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Gas Tax Healthcare Costs Better Healthcare

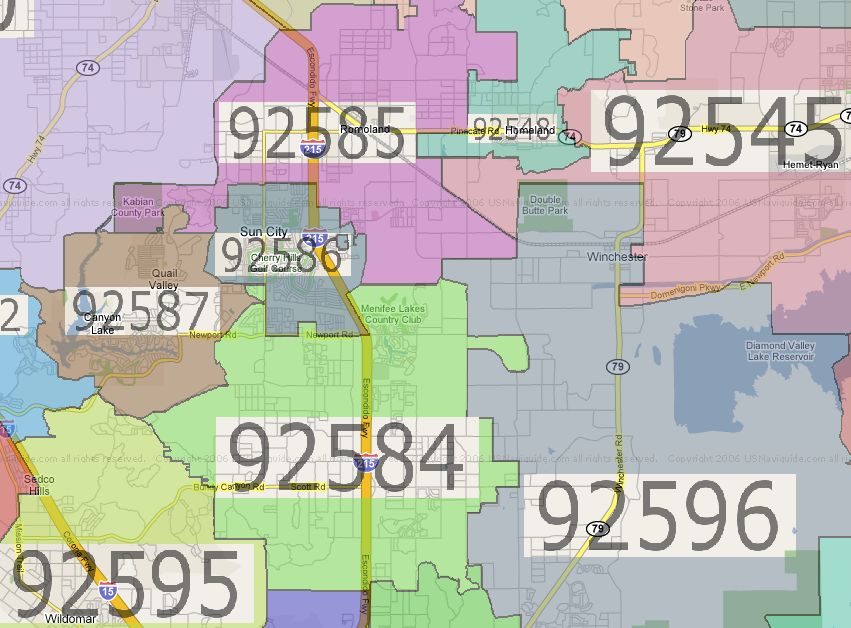

Property Taxes By Zip Code No Only By County

Ventura County Assessor Supplemental Assessments

Property Tax How To Calculate Local Considerations

States With The Highest And Lowest Property Taxes Property Tax Tax States