average property tax in france

For properties more than 5 years old stamp. We Can Help With Your French Tax Return.

French Property Tax Considerations Blevins Franks

Rental income in France is taxed at a flat rate of 25 per cent for non-residents.

. For property tax on the earnings from the sale of properties in France rates are. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property. Taxe dhabitation local taxes This tax is only due on a habitable building.

Homes with a net taxable worth of over 13 million US16 million are subject to the tax although debt on the property and taxes already paid may reduce the taxable amount. Rate The rate is 509 580 for real estate located in France. But if you are buying secondary homes you will be charged 3.

Lets say you have a net taxable income of 20000 euros a year. The French taxe foncière is an annual property ownership tax which is payable in October every year. Tax dhabitaion And Tax Foncière Tax dhabitation is being phased out and will have mostly gone by the end of 2021.

In 2021 this tax is set at 138 per year in mainland France. We Help You Minimise Your Tax Liability And Maximise Your Real Estate Profit Potential. Ad Do You Own Income Property In France.

You are liable for this tax if the net value of your property in France exceeds 1300000 euros. In France tax rates work in slices. We Can Help With Your French Tax Return.

If a property is furnished. If you do not have a TV or similar device computers with online subscriptions such as Netflix do not count you can. Water sewerage electric and gas 16250.

This will be followed by a 65 per cent reduction in 2019 and a 100 per cent. We Help You Minimise Your Tax Liability And Maximise Your Real Estate Profit Potential. You can use all infographics on your own website.

At the moment two separate taxes are levied on every. The tax rate varies between 050 and 150 of the declared value of the. It is payable by the individual who owns the property on the 1st January of the same year.

Ad Do You Own Income Property In France. This amount is further increased by 6000 for each additional dependant in the household. Mandatory property insurance 2642.

With local property tax bills currently being sent out to all French property owners who are the winners and the losers. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. The occupant of the property on the first day of January is liable for paying this tax in full.

The tax is charged. Do I have council tax or rates to pay on my French property. 9700 euros would be free of charge while the remaining 10300 euros would be taxed at 14.

The percentages and the average house prices are calculated on the basis of the number of houses in Franimo per region or department. Nationals are taxed on a sliding scale with a maximum taxable rate of 25 per cent. Each owner of a French property pays a tax to support the local commune this tax varies with the town you live in and it can vary based on what part of the town you live in.

In a survey of 450 towns and cities of France the French. The basis of tax is the price if the real estate is transferred against payment and the market value in other cases. Rental and related investment income from France and taxable in France beyond this level is.

Answer 1 of 2. Tax dHabitation iswas paid by the. In terms of application of the two rates for income up to 26070 the rate remains taxed at 20.

For example If you are buying a primary home in France the property tax rate is around 1. 27 November 2006 Property owners in France have two types of annual tax to.

French Taxes I Buy A Property In France What Taxes Should I Pay

Our Infographics Motivation Famous Motivational Quotes Motivational Thoughts

French Taxes I Buy A Property In France What Taxes Should I Pay

What Countries Have The Highest School Life Expectancy Rates Answers

Taxes In France A Complete Guide For Expats Expatica

Historic Chateau 5 300 000 Eur Pricey Pads

French Taxes I Buy A Property In France What Taxes Should I Pay

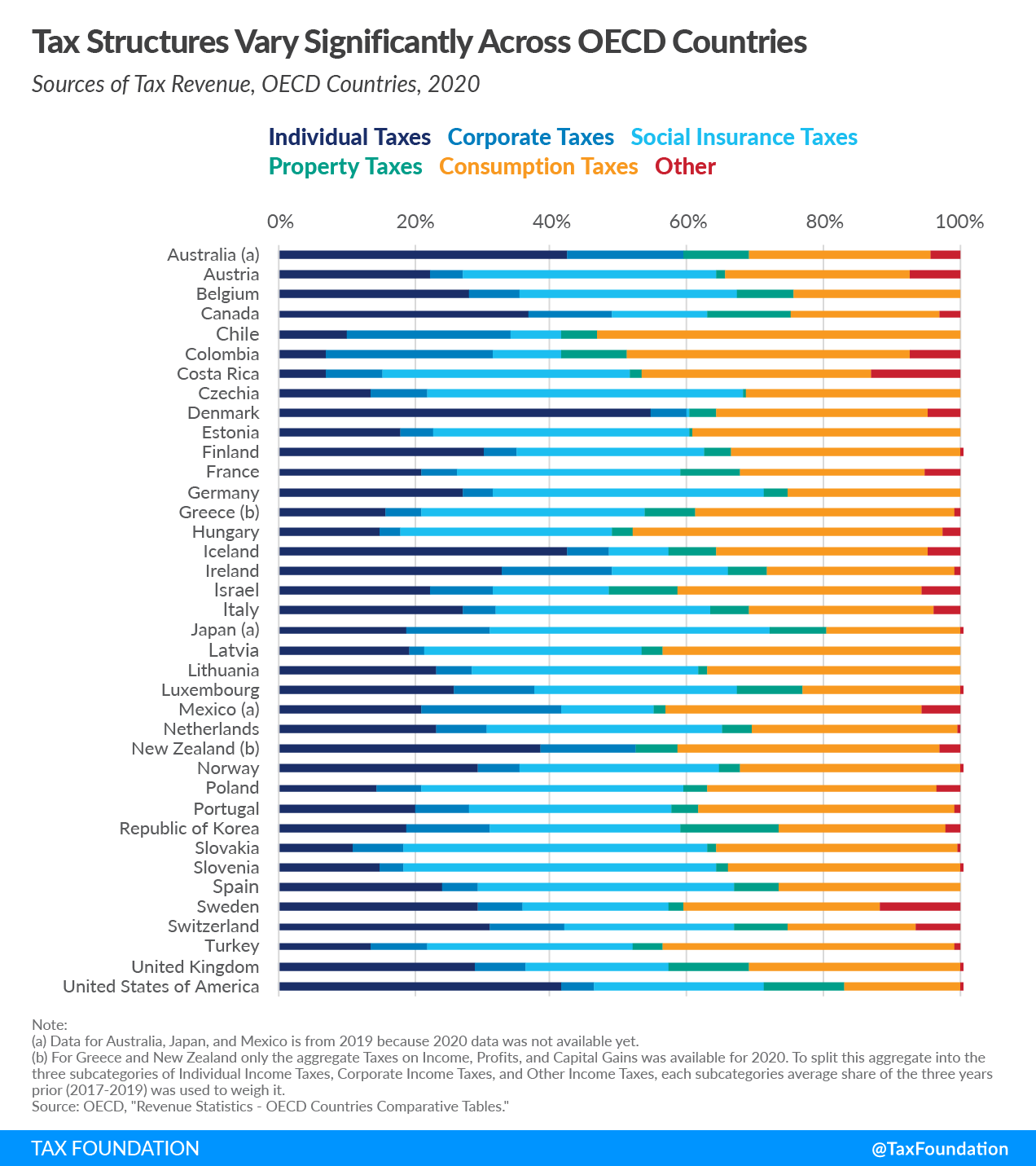

France Tax Income Taxes In France Tax Foundation

14 Self Storage Marketing Ideas Marketing Ideas Storage And Cube Storage

In Depth Guide To French Property Taxes For Non Residents Expats

France Tax Income Taxes In France Tax Foundation

France Tax Income Taxes In France Tax Foundation

Taxes In France A Complete Guide For Expats Expatica

French Taxes I Buy A Property In France What Taxes Should I Pay

Usa Average Vantagescore 2017 675 National Parks Credit Cards Debt Family Income

Https Www Thebalance Com Thmb Adcl9oxxhq2bqfmqfd7scukhyps 1333x1000 Smart Filters No Upscale States Without An Income Tax 36d1 Income Tax Income Sales Tax

France Tax Income Taxes In France Tax Foundation